- Hotline +65 6631 8332

The 3 important online payment platform key players small businesses must know

Friday, 09 Jul, 2021

This article is a part of PayCEC payment insights

Follow PayCEC - global payment gateway to get updates on the latest payment trends and ecommerce news

What's inside?

Tip of the iceberg of the online payment platform may seem so simple, but there’s a lot of complexity happening in the submerged part. In this post, PayCEC will narrow the relevant entities list down to the three most common key players related to the online payment platforms that we often get asked a lot about what these terms mean and how they work.

1. What are the 3 key players involved in the online payment platform?

What is a Merchant Account ?

To accept payments on the online payment platform, you must have a merchant account. Once your application for a merchant account is approved, you will be assigned a merchant identification number (MID). This is an account number for your merchant account.

What is a Payment Processor ?

It is a payment processing company or financial institution that handles the transactions between customer’s bank and merchant’s bank.

What is a Payment Platform ?

A payment gateway, or a payment platform, acts as the bridge between your website and your banking network, allowing secure payment data to flow back and forth. When a customer visits your website, enters their credit or debit card information, and clicks “Send”, the payment platform will authorize the card information and send it to your bank for processing.

PayCEC - the best payment platform for small businesses.

In simpler terms, think of a payment platform to be the online version of a POS (Point-of-Sale) device, which is a physical credit and debit card reader. In common, both collect payment information before encrypting it, and forwarding it to a payment processor for authorization. The primary difference is that e-commerce merchants using payment platform never have direct access to their customers’ credit cards, and rarely (if ever) meet their customers in person.

2. What are the roles of the 3 key players involved in the online payment platform ?

Merchant account

It is required to process online transactions, and move funds from your customer's issuing banks to your business bank account, once their payments are authorized and ready to be settled by your acquirer.

Payment processor

They deal with such questions as credit card validity, available funds, fund settlement, card limits, data security, user authentication, and so on. One more essential function of the payment processor is security. A payment processor is responsible for checking whether card information is valid, and protecting you from fraudulent activities. They also take care of various errors, accidental transactions, and incorrect charges.

Payment platform

As the middleman during the payment processing, a payment platform connects your merchant account with credit and debit card issuers, such as Visa, Mastercard, or American Express, to manage the customer’s sensitive card details, and ensures the transaction is carried out securely and promptly.

Importantly, accepting card payments online is a prerequisite for any successful small business. It is obviously impossible to accept domestic and international online payments if the merchant can’t take payments online, and of course, you will have no business at all. Therefore, setting up a payment platform is absolutely essential as it allows your customers to checkout online easily and securely.

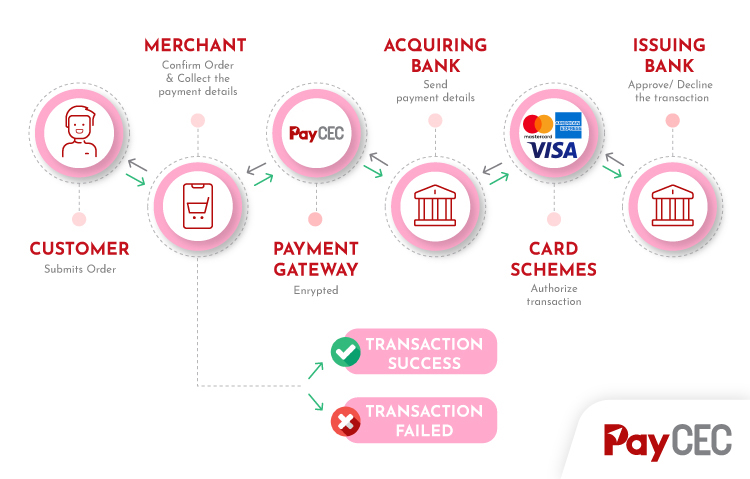

3. How do these key players function in the online payment platform procedure ?

How PayCEC payment platform works throughout the payment journey.

- Step 1: The shopper picks up an item, and adds it to her online shopping cart.

- Step 2: She places an order on your website by pressing the 'Submit Order' or equivalent button.

- Step 3: The merchant submits the order.

- Step 4: The PayCEC payment platform securely sends the transaction to the processor.

- Step 5: The processor verifies and approves the transaction, and routes the transaction to the card association (Visa / Mastercard / American Express).

- Step 6: The shopper has a Visa card. Visa forwards the transaction details to the customer’s bank, which is known as the issuing bank for approval.

- Step 7: The issuer checks if the shopper has enough money in her account to pay for the item.

- Step 8: The shopper just receives money from her friend, so she has more than enough money. The issuer sends a response to the acquirer (merchant’s bank), via the processor.

- Step 9: The processor sends the status (approval or denial) of the transaction to the PayCEC payment platform.

- Step 10: The merchant receives the message “Transaction Approved”, and the fund is deducted from the customer's bank and settled into the merchant’s bank account.

- Step 11: The merchant gets paid for the sold dress, and the shopper has got her new item.

4. The best online payment platform for small businesses

There are two significant factors that can negatively impact small businesses. Firstly, selling to remote, anonymous shoppers comes with a slew of security concerns. Secondly, underfunded, or lack of professional personnel to manage and operate, as well as an inflexible maintenance department can deteriorate the ongoing of small businesses.

Suppose that you are able to view every aspect of all online payments in one system, you will have fewer things to manage and worry about, right? Therefore, the best thing to do when running an online business is to find the right payment platform provider.

PayCEC online payment platform is one of the first lines of defense in fraud prevention. It keeps sensitive payment details out of the hands of criminals by offering powerful security features, such as: 3D secure, Tokenization, and PCI DSS compliance.

Moreover, PayCEC payment platform provider offer uninterrupted 24/7 support, so that whenever a customer has any issue with a payment, our Relationship Managers can address it immediately. Besides, PayCEC has a team of technical specialists to support you in online payment platform installation and integration. With round-the-clock support and best-in-class service, PayCEC has gone far and beyond merchants’ expectations, and become small businesses‘ favorite online payment platform ever.

PayCEC's comprehensive global payment platform has become vital for small businesses to stay ahead of the game in today’s highly competitive e-commerce marketplace. By integrating PayCEC - the best payment platform for small businesses, you can easily track all online payments through a merchant dashboard, and offer the highest level of sensitive data protection in order to deliver greater customer satisfaction.

Read more:

- Online Payment Gateway

- Ecommerce merchant account solutions

- Payment gateway integration tutorial

- The best online payment gateway platforms in UK

- Online payment gateway in USA

About us

PayCEC virtual payment gateway was established in response to the growing need of businesses to accept online payments more quickly and easily. In the digital era, our payment flow has evolved to work seamlessly and effectively across all platforms and devices. We pride ourselves on combining superior technology with first-class customer service.

PayCEC virtual payment gateway is a truly global payments platform that not only allows customers to get paid instantly and securely, but also withdraws funds to their business accounts in various currencies.

We have created an open and secure payments ecosystem that entrepreneurs and businesses choose to securely transact with each other online and on any device. We proudly maintain the highest level of client advocacy in the industry.

PayCEC Team

Frequently Asked Questions

What is a payment platform?

Payment platform or usually called payment gateway is the technology that reads and transfers payment information from a client to a merchant's bank account. Payment platform is an online cloud-based software that connects a customer to the merchant.

How does a payment platform work?

As the middleman during the payment processing, a payment platform connects your merchant account with credit and debit card issuers, such as Visa, Mastercard, or American Express, to manage the customer’s sensitive card details, and ensures the transaction is carried out securely and promptly.

Importantly, accepting card payments online is a prerequisite for any successful small business. It is obviously impossible to accept domestic and international online payments if the merchant can’t take payments online, and of course, you will have no business at all. Therefore, setting up a payment platform is absolutely essential as it allows your customers to checkout online easily and securely.

How PayCEC payment platform works throughout the payment journey.

- Step 1: The shopper picks up an item, and adds it to her online shopping cart.

- Step 2: She places an order on your website by pressing the 'Submit Order' or equivalent button.

- Step 3: The merchant submits the order.

- Step 4: The PayCEC payment platform securely sends the transaction to the processor.

- Step 5: The processor verifies and approves the transaction, and routes the transaction to the card association (Visa / Mastercard / American Express).

- Step 6: The shopper has a Visa card. Visa forwards the transaction details to the customer’s bank, which is known as the issuing bank for approval.

- Step 7: The issuer checks if the shopper has enough money in her account to pay for the item.

- Step 8: The shopper just receives money from her friend, so she has more than enough money. The issuer sends a response to the acquirer (merchant’s bank), via the processor.

- Step 9: The processor sends the status (approval or denial) of the transaction to the PayCEC payment platform.

- Step 10: The merchant receives the message “Transaction Approved”, and the fund is deducted from the customer's bank and settled into the merchant’s bank account.

- Step 11: The merchant gets paid for the sold dress, and the shopper has got her new item.

What are the 4 main methods of online payment?

There are 4 types of major online payment methods:

- E-wallets

In 2020, digital and mobile wallets accounted for roughly 45 percent of global e-commerce payment transactions, making the digital wallet by far the most popular online payment method worldwide. Although digital and mobile wallets were globally the leading choice when buying online, some regions used this payment method more than others. For instance, the digital or mobile wallet was most popular in the Asia Pacific Region, where it accounted for approximately 60 percent of e-commerce transactions in 2020. In contrast, this method’s transaction share amounted to only about 20 percent in Latin America.

Consumers in the United Kingdom and the United States both liked using digital or mobile wallets when paying for products or services online. One major difference between these two groups, however, was their approach to card payment methods.

- Credit cards & Debit cards

Credit/Debit cards usually known as payment cards are one of the most popular online payments when it comes to ecommerce and online business. Consumers have a variety of choices to open cards from different card issuers namely Visa, Mastercard, American Express, JCB, Discover, etc. To pay online, customers are required to provide card details whether they own a physical card or virtual card at the checkout pages to complete the purchase process.

Credit cards ranked second with a 23 percent market share in 2020, a figure which is projected to decline in the coming years.

Approximately 30 percent of online shoppers in the UK made payments using debit cards, while U.S. shoppers had a clear preference for credit cards in 2020.

- Bank transfers

Digital banking transfers accounted for about 7.7% in 2020. Many consumers prefer to choose bank transfer to pay for their bills, or to buy goods or services with huge budgets. In Europe, bank transfers or wire transfers are made with IBAN (international bank account number) in the SEPA network. Online businesses can leverage this method to accept payments from shoppers and scale up their company.

- Crypto

Cryptocurrencies are a new emerging trend not only in digital investment but also in payment. A lot of people choose crypto payments to purchase goods, foods and services popularly. Now there are more and more companies that accept crypto like Micrisoft, Paypal, Overstock, Whole Food, Etsy, Starbucks, Newegg and Home Depot, etc.

What is the best method of payment?

In general, when shopping online, credit cards are by far the most secure and safe payment method. To keep your accounts and personal information safe, credit cards use online security features like encryption and fraud monitoring. In addition, paying with a credit card nowadays is much more secure with 3D check out. 3D Secure is an authentication service for secure online card payment that is recommended by VISA, Mastercard, JCB and AMEX. "3D Secure" is the general term for authentication services provided by each card brand under different names.

News

Business

Products

who we are

about us

We are honored to serve as your reliable business partner and financial service provider in the industry and other business-related services. With the help of our professional staff, to help merchants to achieve their goals for the development and expansion of the international business market.

Our payment flow has developed in the e-commerce world to perform seamlessly and effectively across all platforms and devices. We take pleasure in combining technology with customer service, to solve your concerns at the moment.

PayCEC is a fully worldwide payment network that not only allows merchants to be paid immediately and securely, but also allows them to withdraw money in multiple currencies to their company accounts.

+65 6631 8332

+65 6631 8332

Processing

Processing